To what extent does EU internal market balance need exports? Does export orientation increase the risk of crisis or does it play a role in hedging risks?.

Are there particular economic models that ensure resilience?.The first debate was guided by the following questions: The meeting focused on the sector’s socio-economic dynamics: structure of the sector across and within EU countries, export orientation, short supply chains, socio-economic relevance for rural areas, rural development measures for pigmeat, State aid and CAP strategic plans. There were over 130 participants and 12 presentations. The first of these meetings took place online on 6 April. The five meeting reports will flow into a final report with possible recommendations. Each meeting is dedicated to a specific topic and its output is shared on this webpage for the benefit of all.

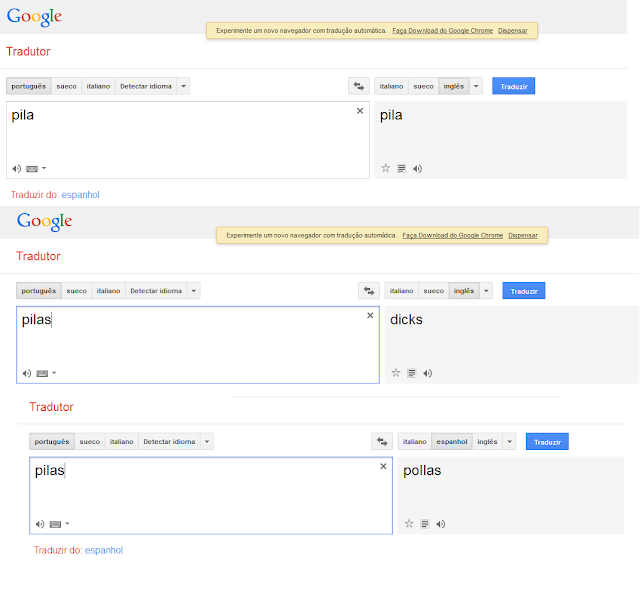

#Translate esse series#

This is a series of joint meetings of the pigmeat section of the Civil Dialogue Group for Animal Products, and the animal products section of the CMO Expert Group.Ī kick off meeting took place on 10 March, effectively launching the group's work in the presence of Commissioner Wojciechowski.įive plenary meetings are planned in 2022. The way forward requires in-depth reflection, as present difficulties go beyond the seasonal fluctuations of the pig cycle.Īgainst this background, Commissioner Wojciechowski announced the creation of a European Pigmeat Reflection Group.

#Translate esse download#

(650.37 KB - PDF) Download Regulation of supply of PDO/PGI hamĮuropean Union countries are allowed, under certain conditions, to apply rules to regulate the supply of protected designation of origin (PDO)/protected geographical indication (PGI) hams upon the request of a producer organisation, an interbranch organisation or a PDO/PGI group. The agri-food data portal gives market data on national and EU agriculture such as process, production, trade, tariff rate quotas. The trends on how the market for pork is expected to develop can be found in the Commission's short-term and mid-term reports. The aim of the meat market observatory is to provide the EU beef, veal and pork sector with more transparency by providing up to date market data and short-term analysis.Īt the monthly committee for the common organisation of the agricultural markets the European Commission presents the market situation in the pig sector. Only in very limited cases have private storage schemes been used to stabilise pig markets during times of crisis. Pork is covered by the common market organisation and has never been subject to linked payments or production quotas.

Most of the EU's pork exports go to East Asia, in particular China. The EU exports about 13% of its total production. The EU's main producer countries are Germany, Spain and France and between them they represent half of the EU's total production. The EU is the world's second biggest producer of pork after China and the biggest exporter of pork and pork products.

0 kommentar(er)

0 kommentar(er)